Many businesses and investors explore the benefits of setting up a holding company to achieve stronger control and long‑term growth. This approach can protects assets, simplify complex operations and also be tax efficient. In this article we explore those benefits, the situations where it works best, and the key points you need to consider.

What is a Holding Company?

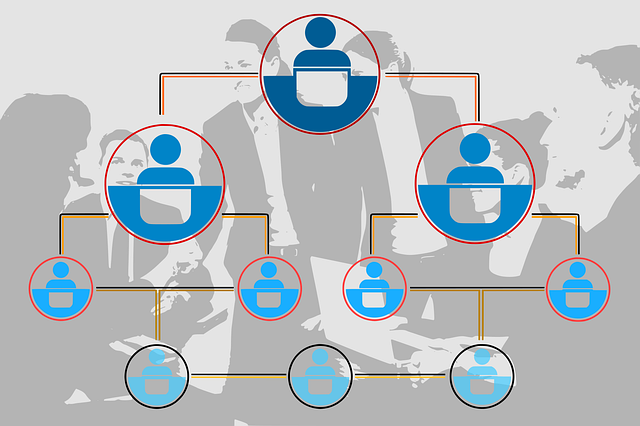

Put simply, a holding company is a company created purely to own shares in other businesses.

Unlike a trading company, it does not directly sell products or services. Its main purpose is to hold controlling shares or interests in subsidiary companies

As a result, this structures enables you to control a group of companies whilst gaining protection and tax advantages..

Why use this structure?

Understanding the benefits of setting up a UK holding company can transform how you manage risk and growth. This type of structure enables you to separate assets, reduce tax liabilities and drive expansion without yet still retain control. We discuss these advantages below:

Asset Protection

Protecting your company's assets is vital, especially with the current uncertainty in the markets. Therefore, using a holding company structure places valuable assets—for example, property, intellectual property or cash reserves—beyond direct operational risk.

What's more, your trading subsidiaries handle day‑to‑day activity. These frequently carry debt, contracts and customer claims. If one of your subsidiaries fails, your creditors cannot reach assets locked safely in the holding company.

Equally importantly this creates a clear delineation which engenders confidence and long‑term security for both you as the founder and your fellow director and shareholders.

Tax advantages

You can obtain a number of tax advantages from a holding company structure. We'll explore these in greater detail at a later date. However some examples are as follows:

Simplified management

Where you are running multiple businesses it can feel chaotic and you can feel overwhelmed.

However, a holding company provides you central oversight whilst simultaneously enabling each subsidiary to focus on its market.

Additionally, you can appoint one board to set strategy, monitor performance and enforce governance. Group reporting becomes simpler, with consolidated accounts providing a clear picture of overall performance in the round..

As a result, this approach saves time, reduces duplication and helps you plan with clarity.

What's more Investors also value this transparency and often prefer dealing with a parent company.

Driving Investment and Growth

A holding company unlocks expansion without disruption .This can enable you to acquire a new business and accommodate it within your group quickly.

Furthermore, your existing subsidiaries can continue operations without disruption.

Additionally, if a subsidiary company no longer suits your vision, this can be disposed easily by the holding company.

Because of the tax advantages available, acquisitions and disposals become far more attractive financially. As a result, this flexibility enables you to act fast in a competitive market. Additionally, it provides a strong platform to scale internationally.

Succession Planning

Planning for the future is crucial, especially in family businesses. Therefore, a holding company enables you transfer shares to family members with the minimum of disruption to business operations. This structure can provide an alternative to a family investment company.

The group's ownership may change though key managers/employees can ensure the keep the group continues to perform.

A holding company structure avoids disputes by creating clear lines of control. Additionally, it can also reduces the tax impact on transfers, preserving value for future generations. As a result, you can build a legacy whilst keeping the business stable and focused on growth.

When to Consider a Holding Company

If you run several different ventures, this structure keeps them separate yet connected.

You can manage risk individually while sharing group resources like finance and expertise.

Where you hold high‑value assets, place them in the holding company for added security. Plus where you are planning acquisitions or disposals, a holding company offers smoother transactions and potential tax benefits.

Where you hold high‑value assets, placing them in the holding company adds security. Plus where you are planning acquisitions or disposals, a holding company offers smoother transactions and potential tax benefits.

Finally, international growth also becomes simpler because your holding company can sit at the centre of global subsidiaries.

Points to consider

Whilst there are benefits associated with setting up a holding company it comes with responsibilities.

Forming and running a holding company structure invariably has extra administration and cost. However, a holding company does not run daily operations. Therefore it's important that governance ensures subsidiaries follow group strategy and perform effectively.

Summary

Exploring the benefits of setting up a UK holding company can provide valuable opportunities for your business. You can gain asset protection, tax efficiency, strategic growth options and clear succession planning.

With careful planning, you can build a structure that attracts investors and safeguards the future. However if you are considering a re-organisation of your business to include a holding company structure obtaining HMRC clearance beforehand is vital.

For more useful information, check out our Ebooks here.

And if you'd like to know how we can help you with all of this, or with anything else, feel free to give us a call on 01202 048696 or email us at [email protected].

Alternatively, please feel free to complete our Business Questionnaire here.