If you're starting a new business, this article will guide you with the options of operating as a sole trader or limited company for the new tax year, Furthermore it takes into account the changes in the 2024 Spring Budget.

Sole trader or limited company - overview

The tax saved by running your business as a sole trader, or a company depends on many variables.

So, if you run a straightforward small business planning to take all the income annually, operating as a sole trader may be less expensive. Additionally it's easier to manage from an administrative point of view.

However, you may plan to take advantage of company-only tax reliefs such as tax-free benefits, employer pension contributions. Additionally, you may plan to exit the business after a short period. So there may be substantial cost-savings achieved by operating as a limited company.

Advantages of a limited company structure

There are a number of advantages of operating as a limited company when considering whether starting business as a sole trader or limited company:

- Firstly It is easier to raise funds for investment into a company if you're anticpating a trade sale. It may require external investors, If so, only investment in a company attract investments such as SEIS.

- A company can save tax if you retain profits in the business. What's more those profits generated for sole traders and partners are subject to Income Tax and NICs regardless of withdrawal. Conversely, with a company, profits retained in the company are not taxed.

- You can retain a company, as a 'money box'/pension. A former trading company can transform into a Family Investment Company on retirement. Furthermore, this allow sharing of profits with your family. They can utilise unused personal allowances and basic rate tax bands.

- A company can provide you with numerous tax-free perks and benefits. If you are a sole trader, you don't have the same tax-free benefits as a director. These include mobile phones, computers, training costs, low-emission cars, plus company pension and medical schemes.

- It is cheaper to pay dividends rather than salaries. National Insurance is reduced, and the top rate of tax for a dividend is lower than earnings as a sole trader. You can calculate the best combination of salary compared with dividends to suit you. Furthermore you can split dividends between a spouse, partner or other adult family members for tax effeciencies

Operating as a sole trader

Some of the advantages of operating as a sole trader are as follows:

- Firstly, it is very easy to set up a new business as a sole trader. This is the recommended route if you're starting up a small business on your own for the first time

- Secondly, once you have set up as a sole trader, it's easy to change to a partnership or into a company. This may apply if your business grows and you want the protection of limited liability).

- There is no legislation that directly describes the operation of a sole trader. If you're a sole trader you run your business according to general law not by the Companies Act.

- Only sole traders are eligible to use the cash basis of accounting for their business. Therefore this makes accounting for business transactions more straight-forward than for a limited company.

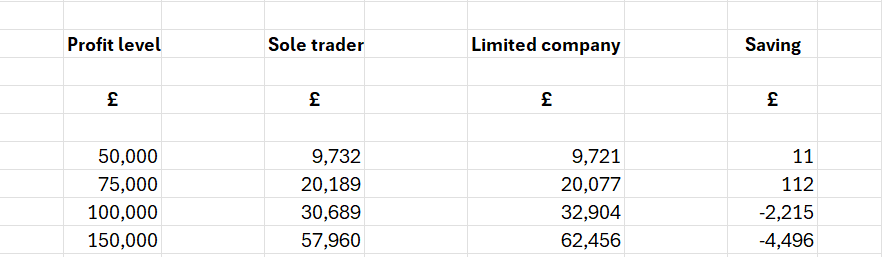

The potential tax savings

No article on a sole trader or limited company structure for a new business would be complete without discussing the potential tax savings which are covered below.

Does this mean that sole trader is the best structure?

On the surface of it, this would suggest that you pay more tax not less tax if you decide to operate as a limited company. However this doesn't represent the whole story because the following assumptions have been made:

- This is your only source of income and the full personal allowance and basic rate tax bands are available.

- You take a modest salary to reduce NI contributions and you can claim the Employer Allowance.

- All remaining profits are taken as dividends.

A number of variables will affect the above calculations and potential tax savings:

- Whether you can split the company's income with a spouse or around the family.

- Specific tax reliefs and allowances which may apply to the business - for example R&D tax reliefs

- Whether you have income from other sources.

- The level of employer pension contributions that are made

- How much profit is retained and paid out as a capital distribution when your company is wound up.

Summary

As with all tax planning, there is rarely if ever a 'one size fits all' approach when decided whether to start a new business as a limited company rather than as a sole trader - a number of factors have to be considered.

For more useful information, check out our Ebooks here.

And if you'd like to know how we can help you with all of this, or with anything else, feel free to give us a call on 01202 048696 or email us at [email protected].

Alternatively, please feel free to complete our Business Questionnaire here.